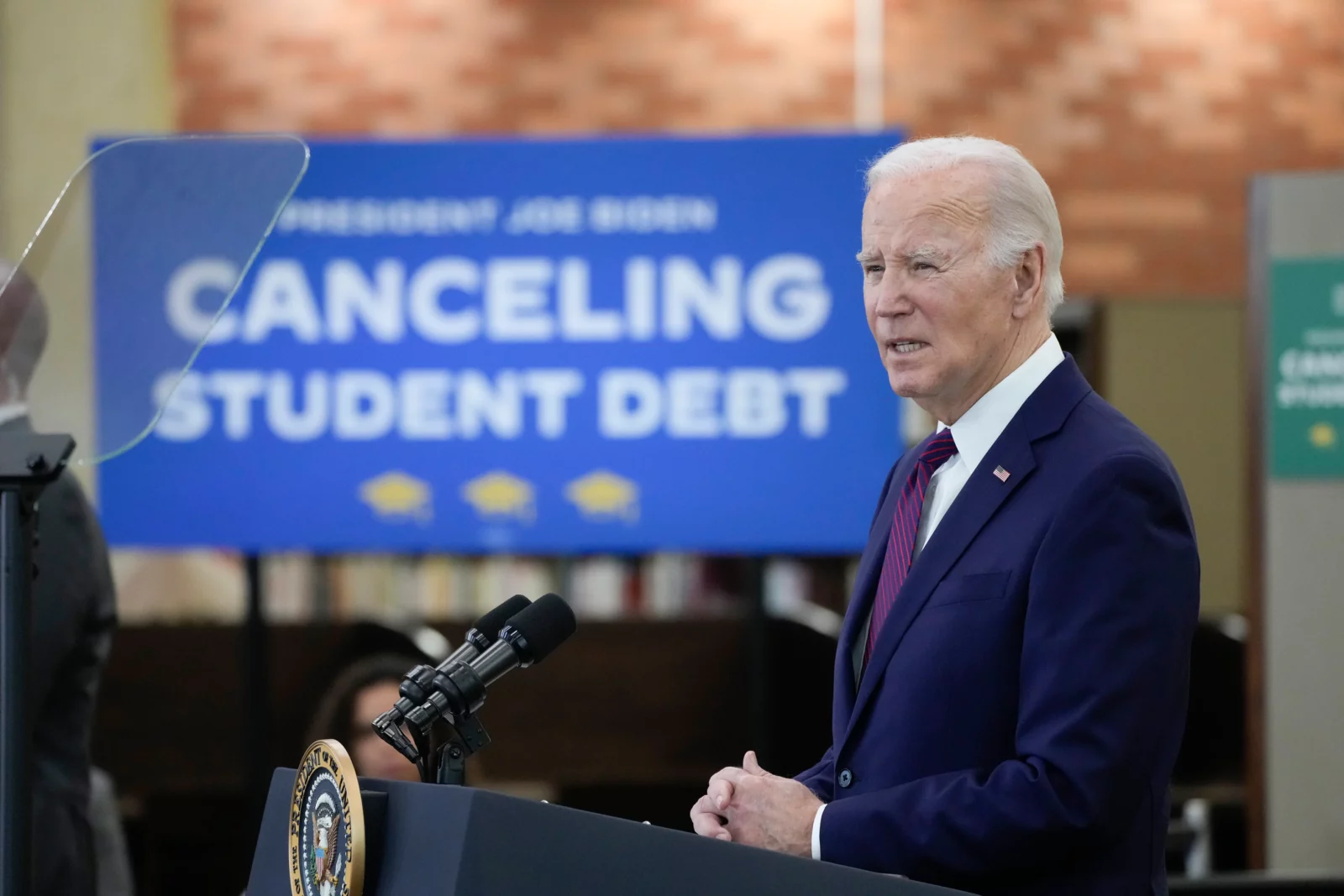

Under President Joe Biden, the spotlight has been focused on his campaign plans to cancel billions of dollars in student debt as he gets into the election year.

Expedited Debt Relief

Biden, who is smack in the middle of his three-day tour of California, declared yesterday that Federal student loans are automatically written off for roughly 153,000 borrowers as part of a new plan that offers a swifter level of forgiveness.

The alert emails have already started going out on Wednesday to some of the borrowers who will be enrolled in the administration’s Student Aid through Verification and Enforcement (SAVE) program. They were initially set to be implemented in July, but last month, the administration announced that it would be done weeks ahead of schedule. February will be the month it will be executed almost five months before schedule, as reported by The Associated Press.

“Starting today, the first round of folks who are enrolled in our SAVE student loan repayment plan who have paid their loans for ten years and borrowed $12,000 or less will have their debt canceled,” Biden posted on social media Wednesday. “That’s 150,000 Americans and counting. And we’re pushing to relieve more.”

SAVE Plan Presentation

$1.2 billion in debt will be forgiven as part of the SAVE plan’s initial wave of forgiveness. Emails from Biden informing the borrowers that “all or a portion of your federal student loans will be forgiven because you qualify for early loan forgiveness under my Administration’s SAVE Plan.”

The president is scheduled to make a presentation about the SAVE plan in Culver City, California, on Wednesday. After that, he will travel to San Francisco to continue soliciting money for his campaign.

Biden, in the email, writes he has heard from “countless people who have told me that relieving the burden of their student loan debt will allow them to support themselves and their families, buy their first home, start a small business, and move forward with life plans they’ve put on hold.”

In Beverly Hills, during a campaign fundraiser, the president listed his efforts to help middle-class Americans and called a November win by former President Donald Trump, the current GOP presidential front-runner, a complete ban on abortion nationwide, more Republican attempts to begin unraveling the health care program initiated in the Biden administration and policies that would benefit the rich the most, as reported by The Associated Press.

He called up on his supporters to help in ensuring a second term row so that he could “finish the job” of dropping an agenda that benefits American workers.

Borrower Eligibility Criteria

Cancellation of loans is available for those who are enrolled in the SAVE borrowing program, borrowed $12,000 or less for college attendance, and have made payments for more than ten years. Those who borrowed over $12,000 are allowed to cancel but on a longer time frame. For dollars borrowed beyond $12,000, there is an additional one year of payment for every 1,000.

For borrowers with only undergraduate loans, the maximum payback term is twenty years; for those with any graduate school loans, it is twenty-five years, as reported by The Associated Press.

“With today’s announcement, we are once again sending a clear message to borrowers who had low balances: If you’ve been paying for a decade, you’ve done your part, and you deserve relief,” Education Secretary Miguel Cardona said.

Context of Repayment Plan

Biden introduced the new repayment plan last year in conjunction with the other plan of canceling up to $20,000 in debt for more than millions of Americans. The Supreme Court struck down his plan for more widespread forgiveness, and the repayment plan has so far avoided that level of legal scrutiny. However, contrary to his radical idea of major forgiveness — which had never been previously considered — the repayment plan is actually an extension of the income-driven plans introduced by Congress more than a decade ago.